Realizing the Next Wave of Growth: What Leaders Need to Do Now

Co-Authored by Nicholas Cox & Jon Edwards

For more than a decade, companies have been operating within a familiar growth paradigm: capture efficiencies, optimize portfolios, scale proven models, and expand market share through incremental plays. That era is fading. A new wave of growth is emerging shaped by shifts in consumer behavior including fragmented demand and heightened expectations, rapid acceleration of AI, and an uncertain macroeconomic environment.

Many mid-sized companies don’t have the resources to place numerous and varied bets. Yet, they have reached a size where added complexity prevents them from moving fast. This is the mid-market paradox: too large to be nimble, too constrained to bet widely. The companies that break through are those that resist spreading resources thin or defaulting to what worked before. Instead, they build a disciplined engine for identifying and scaling their highest-conviction growth bets.

Growth is being redistributed to companies that can (1) sense changing contexts, (2) design new access and monetization models, and (3) run a repeatable enterprise engine that turns insight into scaled action. The organizations that succeed next won’t simply “push harder” on traditional levers. They’ll embrace a more adaptive, insight-driven, and future-oriented approach to value creation — one built on renewal, repositioning, and re-anchoring on what customers value most.![]()

Why The Old Growth Playbook Is Breaking

Three external forces are converging to redefine how and where value is created across industries:

1. Demand is Fragmenting by Context & Budget

Consumers are navigating a fragmented and unequal “K-shaped” economy, with some segments spending freely while others trade down or exert pressure on value. At the same time, expectations for convenience, transparency, personalization, and trust continue to climb.

Reaching new customers is being redefined to include reconnecting with existing customers encountering new life stages, new contexts, and new moments of need, where legacy offerings or go-to-market approaches no longer resonate. Companies that understand these evolving contexts will be best positioned to create new demand and deepen loyalty.

2. AI is Enabling Companies to Leapfrog Competitors

AI, automation, digital platforms, and advanced analytics are transforming every part of the value chain from how demand forms to how decisions get made. Companies across industries are using AI to enable entirely new revenue streams, customer experiences, and operating models, while simultaneously raising the bar for speed, relevance, and precision.

3. Uncertain Macro Environment Raises the Cost of Wrong Bets

Leaders must navigate an increasingly uncertain macroeconomic environment, including margin compression, supply volatility, geopolitical risk, new regulatory requirements, capital constraints, changing labor dynamics, and ongoing shifts in global competition. These concerns have led to US consumer confidence falling to its lowest level since 2014.1 The result: leaders are scrutinizing every bet far more carefully than before

These consumer, technological, and environmental forces are leading to a redistribution of value toward platforms, ecosystems, and nimble disruptors who can adapt faster than established players.

The Emerging Sources of Growth

Value creation is moving to the intersections where shifting customer needs meet new business and operating models. Across sectors, five sources of growth are gaining momentum:

A. New Needs and Re-segmentation

New growth now comes from deeply understanding unmet needs and jobs-to-be-done, particularly the emerging contexts in which customers make decisions. Re-segmentation is about occasion/context (when/why), not just who. This includes evolving household structures, new demographic patterns, and shifting preferences around affordability, wellness, sustainability, and experience.

Example: Poppi and Olipop both unlocked growth by pursuing jobs-to-be-done that traditional soda didn’t serve. They positioned their products around digestive health, prebiotics, low sugar, and “feel-good” functionality, becoming some of the fastest-growing beverages in the US.

Ask yourself: Are your current segments defined by who your customers were or by what they are trying to accomplish today and tomorrow?”

B. Deepening Existing Customer Relationships

For consumer-focused companies, the highest-return growth opportunity is often already inside the business. Existing customers offer data richness, trust, and openness to new offerings that new customer acquisition cannot match. Companies are driving sustained growth by deepening the value they deliver to people they already have. Loyalty, lifetime value, and advocacy are growth levers and not just retention metrics.

Example: LEGO reversed years of decline not by entering new markets, but by re-engaging its core adult fans, launching Ideas (a co-creation platform), and expanding into experiences (theme parks, movies, digital). Revenue tripled over a decade by going deeper with its existing customers, not just wider.

Ask yourself: Which do you know more about - acquiring a new customer or what would make your best existing customers buy more, stay longer, or bring others in?

C. New Revenue Streams

Companies are increasingly building services around products, introducing subscription and usage models, monetizing data or insights, and entering adjacent categories that complement their core. Innovation is happening at the edges of existing businesses and not just within them. It’s increasingly important for innovation and strategy teams to distinguish between new features vs. new revenue streams to build the right offerings.

Example: Uber expanded its core ride-hailing business and leveraged its existing platform and infrastructure to create new businesses including Uber Eats, Uber Freight, and Uber Direct. By filling in troughs in demand, cross-promoting, offering unified membership, it has grown what were once ancillary businesses to now make up nearly half of Uber’s gross bookings.

Ask yourself: What percentage of your revenue comes from offerings that didn’t exist five years ago? If the answer is small, your innovation is more incremental than it appears.

D. New Channels and Access Models

Channels and distribution models are being rewritten. Access is becoming central to the strategy, not just a route-to-market. Companies are tapping social commerce, digital marketplaces, creator partnerships, B2B enablement platforms, DTC and community-led models, and new forms of last-mile access. These channels often become engines for discovery and engagement, not just conversion.

Example: e.l.f. Beauty has driven exponential growth by moving "at the speed of culture," shifting from a low-cost $1 makeup brand to a culturally relevant, digital-first powerhouse. The brand has doubled its market share in the last five years and become the #1 favorite beauty brand for Gen Z by meeting consumers in unconventional digital spaces from gaming & virtual worlds to TikTok to disruptive partnerships and treating them as co-creators rather than just buyers.

Ask yourself: If a well-funded challenger entered your category tomorrow, which channels would they use that you currently don’t?

E. Business Model Evolution

More organizations are adopting platform, ecosystem, outcome-based, and AI-native business models. They are shifting from linear value chains to interconnected value networks that share data, capabilities, and customers. The companies poised to win are those that flex their business model as customer needs and economic conditions evolve.

Example: Walmart has evolved from a traditional brick-and-mortar retailer into a people-led, tech-powered omnichannel platform. Through Walmart Connect, Walmart+, and Walmart Luminate, the company has added more diversified and durable sources of higher margin revenue including advertising, membership, and marketplace fees.

Ask yourself: Is your business model built to flex as customer needs and economics evolve or is it optimized for conditions that may no longer hold?

The 5 Failure Modes That Stall Growth

The opportunity is real… and so is the gap. Despite clear signals of where growth is moving, most established companies are watching disruptors claim it. The barriers are rarely strategic; they are structural and behavioral. Five failure modes explain why growth stalls even when the path forward is visible:

- Insight Lag: Teams learn too slowly or too shallowly. They lack the deep yet nuanced insight into the world in which their consumers and customers live and work.

- Aperture Lock: Leadership prematurely rules out where to play. They focus too much on today’s business and don’t expand the aperture of the addressable market.

- Activation Gap: Ideas don’t translate to pilots and launch. Too much time is spent on analysis and ideas rather than testing, experimenting, and executing.

- Decision Fog: Data (and insights) exists, but decisions and owners don’t. Clarity is needed on the decisions that data can and should enable.

- Operating Model Drag: Most organizations are structurally optimized for the last wave of growth, not the next one. Incentive structures, P&L ownership, talent profiles, and planning cycles are all calibrated to defend existing businesses. Silos, misaligned incentives, and governance don’t just slow things down — they actively select against the behaviors that new growth requires.

Most companies do not lack ideas. They lack the mechanisms, culture, and cross-functional alignment required to scale them.

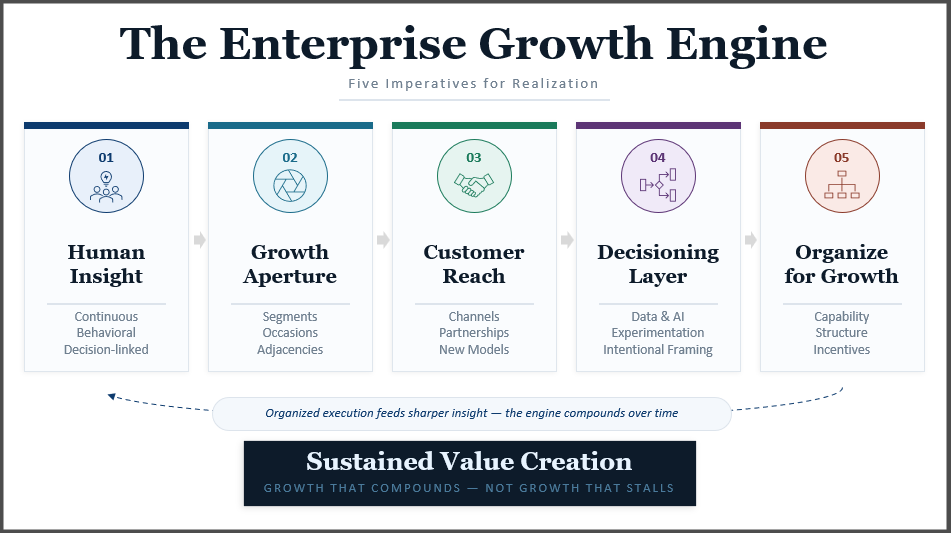

The Enterprise Growth Engine: Five Imperatives for Realization

Capturing the next wave of growth requires a shift from episodic strategy to an enterprise growth engine: a repeatable way of identifying, testing, scaling, and sustaining value creation. Five imperatives define this engine.

1. Build Deep, Continuous, Human Insight That Informs Decisions

Insight is only valuable when it changes or confirms a decision. The foundation of growth is understanding what consumers and customers are trying to accomplish, what frictions they face, and what alternatives they consider. This means:

-

- Understanding jobs-to-be-done and unmet needs

- Investing in behavioral insight, not just attitudinal data

- Using AI to detect emerging microtrends, shifting sentiment, or new needs

- Integrating qualitative + quantitative + real-world behavioral signals

Growth happens when companies see their customers more clearly and quickly than competitors.

2. Expand the Growth Aperture

Replace incrementalism and periodic passion projects with a well-defined strategic planning process to prioritize intentional growth over multiple horizons. Leaders should broaden their aperture to include:

-

- New contexts, segments, and occasions—especially for existing customers

- Adjacent product, service, and experience categories

- Emerging value pools such as data-driven services or ecosystem plays

- Scenario planning and portfolio-based growth bets

This mindset shift creates space for bold, future-forward moves.

3. Reinvent How You Reach and Engage Customers

Winning will require new ways of engaging customers across the entire lifecycle. This includes:

-

- New channels and platforms for discovery, influence, and conversion

- AI-enabled personalization across touchpoints

- Modern commercial models including product-led growth, digital selling, and AI agents making purchasing decisions in both B2C and B2B contexts

- Strategic partnerships that provide access to new markets, share capabilities, enhance innovation, and spread risk

Companies that treat distribution and partnerships as sources of strategic advantage unlock entirely new avenues for growth.

4. Build the Decisioning Layer (Data + AI + Experimentation)

Most companies don’t have a data problem; they have a decision problem. Realizing growth requires both capability and discipline when it comes to data, technology and AI:

-

- Precision audience and targeting strategies enabled by unified data

- Advanced pricing and holistic revenue management

- Experimentation platforms that allow fast A/B and multivariate testing

- AI-enhanced forecasting, content creation, and decision-support

- Clear understanding of what data can—and cannot—unlock

Deployment of AI must be thoughtful and treated as a force multiplier, not a strategy. It accelerates human insight and efficiency but must be tied to the outcomes that matter. As AI makes it easier to do nearly everything, what we choose to do matters more than ever.

5. Organize for Growth

Sustained growth requires alignment between strategy, structure, and leadership… and that alignment must cut across functions. Leaders should focus on:

-

- Breaking down silos and enabling cross-functional ways of working to share data and ensure a connected, enterprise-wide approach to achieving the growth ambition

- Aligning on which decisions must be made where and by whom

- Clear ownership and accountability for growth priorities

- Strategic placement of new businesses within, adjacent, or separate from the core business

- A deliberate build-partner-acquire strategy for pursuing adjacencies with clear criteria for when each path applies

- Capability building across analytics, product, digital sales, data literacy, and experimentation

- Incentives and KPIs aligned to long-term value creation

- Building leadership alignment around a unified growth narrative

Growth is not a function… it’s an enterprise capability.

What Leaders Can Do Now: A Practical Starting Point

These next steps are proven, practical, and durable across industries. They help leaders make progress without waiting for perfect conditions:

- Identify the three major shifts changing how your customers engage and decide.

- Pressure-test your thesis: what growth opportunities are you leaving on the table?

- Establish your 10x growth bets and core accelerators.

- Build the foundations of your Enterprise Growth Engine including data, decision processes, governance, and incentives.

- Launch small but high-velocity experiments in new channels, new contexts, and new partnerships.

- Invest in the capabilities and talent needed for AI-enabled, customer-centric growth.

- Measure success by value created, not activity or output.

Each of these moves is actionable today and each builds momentum toward the next.

Conclusion: The Next Wave of Growth Requires Bold, Adaptable Leadership

Realizing the next wave of growth will not come from optimizing the past. It will come from leaders who embrace new sources of demand, challenge legacy assumptions, and build organizations capable of continuous adaptation.

The companies that accelerate from here won’t do it through a single bold move or a new strategy deck. They will do it by building the enterprise capability to sense, decide, and act faster than their competition and doing so repeatedly, not just once. This requires:

- Bold leadership that charts a clear direction and holds the organization to it

- An operating model built to flex, experiment, and scale

- A culture of continuous adaptation grounded in real insight about customers

The opportunity is extraordinary. The window is open. The question is whether your organization is built to move through it.

By

By